Exploring Commodity Futures OptionsExploring Commodity Futures Options

Exploring Commodity Futures Options: Opportunities and Risks

Introduction

Discover the world of commodity 해외선물 futures options with our expert guide. Our comprehensive article offers valuable insights on the opportunities and risks associated with these investments – perfect for both experienced investors and newcomers. Gain a competitive edge in the market by understanding the intricacies of commodity futures options. Let’s dive in!

What Are Commodity Futures Options?

Discover the world of commodity futures options 선물옵션 – financial contracts that could be your ticket to lucrative investment opportunities. With the power to buy or sell a specified quantity of a commodity at a predetermined price within a specific time frame, you can be in control of your investment decisions. Amongst the commodities you can tap into are oil, gold, wheat, and natural gas, so don’t miss out on the chance to profit from their price fluctuations.

Opportunities in Commodity Futures Options

1. Diversification of Investment Portfolio 해외선물대여계좌

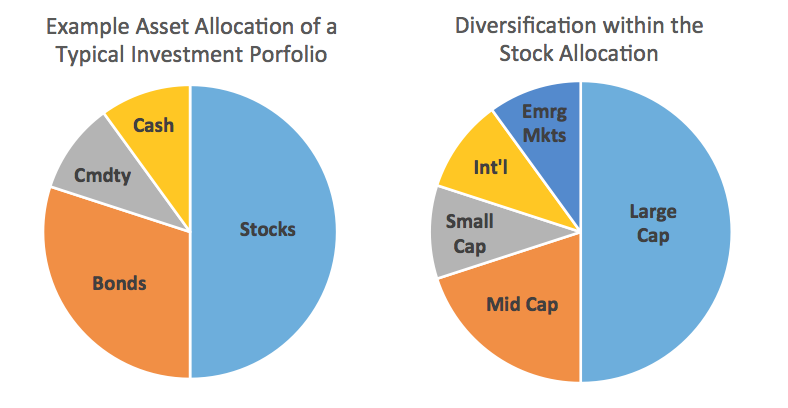

Commodity futures options offer a crucial benefit – the opportunity to diversify investment portfolios. By incorporating commodities into your investment strategy, you can reduce the risks tied to conventional asset classes like stocks and bonds. Commodity investments typically have little correlation with other financial instruments, making them an appealing choice for both risk management and portfolio diversification.

2. Potential for High Returns

Commodity futures options present a profitable 해외선물커뮤니티 venture, especially during times when prices experience significant changes. By making accurate predictions, investors can enjoy amplified returns through leveraged positions. Yet, it is vital to acknowledge that such high returns also accompany amplified risks, necessitating careful analysis and risk management strategies.

3. Hedging Against Inflation

Commodities have always been a reliable tool to safeguard against inflation. This is because their prices tend to rise as inflation increases, providing a solid defense against the devaluation of currencies. Considering commodity futures options as a part of your investment portfolio can assist in protecting your finances during periods of inflation.

Risks in Commodity Futures Options

1. Price Volatility

The unpredictability of commodity markets can make investing a risky endeavor. Multiple factors, including political crises and natural disasters, can swing prices in a matter of moments. Thus, it’s important to approach this market with caution and do your due diligence before making any investments. Proper research and analysis can help you avoid substantial losses and develop robust risk management strategies.

2. Leveraged Positions

Although leverage can boost returns, it can also intensify losses. Commodity futures options provide leverage, enabling investors to manage a greater amount of the underlying commodity with a smaller 해선대여계좌 initial investment. However, leverage can also raise the susceptibility to market fluctuations, which can result in considerable losses if the market moves opposite to the investor’s position. Therefore, prudent use of leverage and effective risk management is crucial when trading commodity futures options.

3. Market and Regulatory Risks

Commodity markets are exposed to market and regulatory risks. Government policies, regulations, and trade agreements, 해선커뮤니티 as well as global economic conditions, affect commodity prices and availability. Geopolitical tensions further cause uncertainties in commodity markets. Staying updated with market dynamics and news is imperative to manage these risks effectively.

Conclusion

Commodity futures options present attractive investment potential for investors seeking to diversify their portfolios, secure high returns, and safeguard against inflation. While these benefits are alluring, it is crucial to acknowledge the associated risks, including price fluctuations, 해외선물사이트 leveraged positions, and market uncertainties. To succeed in commodity futures options, investors must prioritize meticulous research, risk management, and informed decision-making. By doing so, they can fortify their investment strategies and maximize their returns in this dynamic market.